Edenred Card Cadou - Transformă beneficiile extrasalariale în avantaje reale pentru angajații tăi

Cu Cardul Cadou Edenred le oferi angajaților un beneficiu extrasalarial valoros la fiecare eveniment deosebit, în timp ce aduci economii în bugetul companiei.

De ce să alegi cardul cu tichete cadou Edenred pentru echipa ta?

Cu Edenred Tichete Cadou îți faci viața mai ușoară atunci când vine vorba de recompensarea echipei tale. Nu numai că îmbunătățești nivelul de satisfacție a angajaților la locul de muncă, dar îi și motivezi și le oferi libertatea de a alege ce achiziționează. Și toate acestea în timp ce obții pentru companie reduceri semnificative de costuri și un adevărat avantaj competitiv pe piața muncii.

Cardul cadou Edenred este disponibil in format fizic (tip card) sau virtual.

Indiferent că vorbim despre recompense de sărbători sau alte ocazii speciale, Tichetele Cadou Edenred sunt soluția ideală pentru angajatori și angajați deopotrivă.

-

Economii pe termen lung. De ce să nu investești inteligent în angajații tăi, economisind pe termen lung și păstrând finanțele companiei în echilibru? Alegând Cardul Cadou Edenred aduci un zâmbet pe fețele angajaților tăi, în timp ce te bucuri de avantajele fiscale, care îți reduc cheltuielile legate de taxe și contribuții sociale.

-

Flexibilitate în gestionarea beneficiilor. Cu Cardul Cadou Edenred, ai libertatea să personalizezi beneficiile după nevoile și dorințele angajaților tăi. Tu decizi când, cum și cât să oferi, fără să te încurci în proceduri administrative complicate.

-

Creșterea satisfacției și motivației echipei.O echipă fericită este una loială. Iar prin oferirea de Tichete Cadou Edenred angajaților tăi, fix asta obții: îmbunătățirea gradului de satisfacție și loialitate față de companie, prin simplul fapt că le arăți angajaților tăi cât de mult le apreciezi efortul.

-

Libertatea de a alege cadourile preferate. Fiecare angajat are gusturi și dorințe diferite, iar cu Tichetele Cadou Edenred poți să ții cont de asta. De la îmbrăcăminte, încălțăminte și bijuterii, la mobilier și electrocasnice – fiecare angajat are libertatea de a alege ceea ce-și dorește atunci când folosește Edenred Card Cadou la partenerii noștri.

-

Acces la o rețea extinsă de parteneri. Cardul Cadou Edenred poate fi utilizat în cea mai dezvoltată reţea de parteneri tichete cadou cu prezenţă naţională, care acoperă toate tipurile de produse și servicii. Atât de multe opțiuni cu un singur card!

-

Experiență rapidă și ușoară de utilizare. Simplu, comod și fără bătăi de cap – așa se poate descrie utilizarea Cardului Cadou Edenred. Acesta poate fi folosit ca un card de debit obişnuit, iar fiecare tranzacţie este aprobată de beneficiar prin introducerea codului PIN.

Cardurile cadou Edenred sunt disponibile în format fizic (tip card) sau virtual

Cardul fizic Edenred funcționează asemănător unui card bancar, așa că oricine poate să-l utilizeze ușor, indiferent de cât de familiarizat este noile tehnologii. Poate fi utilizat la peste 57.000 de comercianți parteneri, inclusiv platforma de food delivery Sezamo. Valabilitatea cardurilor este de 5 ani de la emitere, oferind o soluție de durată pentru beneficiile extrasalariale.

Cardul virtual Edenred este o 100% soluție digitala, inovatoare, prietenoasă cu mediul, susține eliminarea plasticului din procesele de producție, este activabil în aplicația Edenred, permite plăți sigure, rapide, prin Apple Pay și Google Pay direct de pe telefon. Ideal pentru angajații care preferă soluții digitale!

Avantajele fiscale: tot ce trebuie să știi despre legea tichetelor cadou și impozitare

Legea nr. 165/ 2018, cu modificările și completările ulterioare, este cea care reglementează aspectele legate de impozitarea tichetelor cadou. Și, conform legislației în vigoare, vorbim despre tichete cadou neimpozabile: tichetele cadou pentru angajați sunt scutite de contribuții sociale și de impozitul pe venit, în limita a 300 RON de persoană.

De asemenea, sumele alimentate prin cardul cadou pot fi alocate din bugetul cheltuielilor sociale și sunt deductibile fiscal până în limita a 5% din valoarea cheltuielilor cu salariile personalului.

Cu Tichetele Cadou Edenred, zilele de sărbătoare, indiferent că vorbim despre Paște, Crăciun, 8 martie, 1 iunie sau alte sărbători similare ale altor culte religioase, pot fi mai valoroase pentru angajații tăi. La propriu. Acestea pot fi în cuantum de 300 RON/eveniment/persoană, dacă vrei să te încadrezi în valoarea maximă a tichetelor cadou neimpozabilă. Însă, desigur, poți să le oferi și mai mult.

Astfel, cu tichetele cadou de Crăciun sau de Paște, de exemplu, angajații pot alege cadouri care le sunt cu adevărat utile, de la comercianții din rețeaua Edenred. Iar tu, ca angajator, economisești timp și resurse, concentrându-te pe ceea ce contează cu adevărat: motivația echipei tale și succesul companiei.

Unde poți folosi cardul cadou Edenred

Descoperă rețeaua de magazine partenere!

Angajații pot folosi Cardul Cadou Edenred într-o rețea diversificată de magazine care primesc tichete cadou din diverse domenii: frumusețe, modă, sport, IT, home & deco etc.

Cum se folosesc tichetele cadou

În calitate de angajator, gestionarea tichetelor cadou prin platforma MyEdenred este ușoară și rapidă. Fără stres și fără hârtii – totul se face rapid și eficient. Ai și control complet asupra procesului – de la încărcarea fondurilor în Cardul Cadou Edenred, până la distribuirea acestora către angajați.

Poți chiar să și renunți la distribuirea fizică a cardurilor, dacă alegi cardurile cadou virtuale. Acestea sunt livrate rapid prin e-mail, eliminând costurile de livrare și transport și necesitatea plasticului, și sprijinind obiectivele de sustenabilitate ale companiei. Deci, cu fiecare card digital, contribui la un viitor mai verde, reducând impactul businessului tău asupra mediului.

Eliminând gestionarea fizică a cadourilor și simplificând munca echipelor de resurse umane, cardurile digitale Edenred ajută la optimizarea proceselor tale interne și la economisirea de resurse umane și de timp alocate acestui proces.

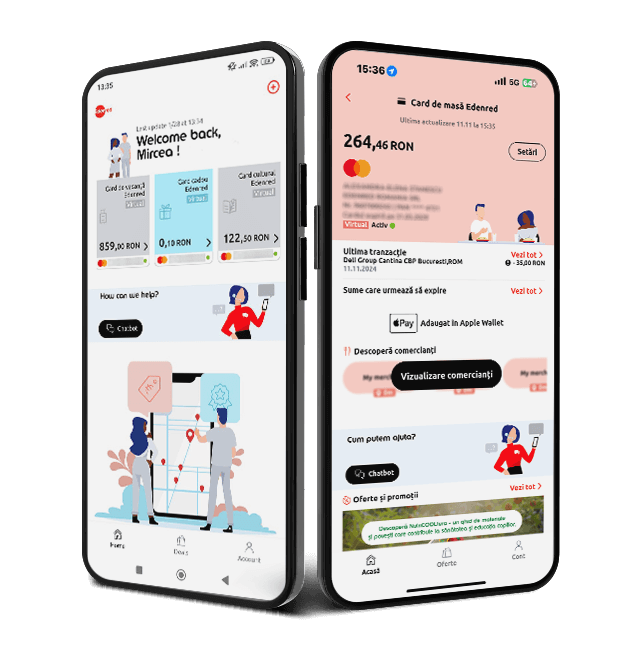

Aplicația Edenred - Administrează-ți resursele simplu și rapid

- Adăugare carduri și activare carduri Edenred (din cont Edenred și pe my.edenred.ro)

- Verificare sold card Edenred, verificare sold card bonuri de masă în timp real și tranzacții

- Notificări în timp real

- Administrare carduri virtuale de fidelitate ale comercianților preferați

Pentru angajați, aplicația Edenred face ca folosirea tichetelor cadou să fie o experiență fără efort. Aceștia pot verifica soldul disponibil în timp real, pot vedea istoricul tranzacțiilor și primesc notificări despre fiecare plată. Tichetele pot fi utilizate direct cu cardul Edenred, fie în magazine fizice, fie online, oferind o flexibilitate maximă în alegerea cadourilor preferate. Totul este la îndemână, rapid și sigur! De asemenea, ele pot fi utilizate și direct din aplicația Edenred, atunci când alegi soluția cardurilor virtuale. Banii sunt la îndemână și pot fi folosiți fără stresul pierderii cardului fizic.

Nu te poți hotărî?

Te ajutăm să găsești soluția care se potrivește pentru business-ul și angajații tăi.

Solicită ofertă personalizată Sau sună-ne direct la 021 301 33 15

Recenzii Edenred: ce spun clienții noștri

Ne bucurăm să oferim clienților noștri experiențe de care pot fi mândri. Ne place să lăsăm clienții să vorbească pentru noi. La rândul lor, 9 din 10 companii ne recomandă cu încredere. Iată ce spun partenerii noștri despre colaborarea cu noi:

Solicită o ofertă personalizată gratuit, fără obligații

Întrebări frecvente

Cine poate beneficia de cardurile cadou Edenred?

Conform dispoziţiilor legale în materie, tichetele cadou sunt bilete de valoare acordate, ocazional, propriilor angajaţi, pentru cheltuieli sociale.

Cardurile cadou Edenred acordate propriilor salariați sau în beneficiul copiilor minori ai acestora în limita a 300 de lei /persoană/eveniment sunt scutite de la plata contribuțiilor sociale obligatorii şi a impozitului pe venit. Evenimentele sociale care beneficiază de tratamentul fiscal menționat anterior sunt cele prevăzute expres de Codul fiscal, respectiv Crăciunul, Paştele, sărbătorile similare ale altor culte religioase, 8 Martie (pentru salariate) şi 1 Iunie (pentru copii). Tichetele cadou acordate care depășesc limita de 300 de lei/persoană/eveniment sunt supuse atât impozitului pe venit, cât și contribuțiilor sociale obligatorii Totodată, contravaloarea tichetelor cadou acordate de către angajator reprezintă cheltuieli deductibile în limita a 5% din valoarea cheltuielilor cu salariile personalului.

Începând cu 1 ianuarie 2022 este interzisă acordarea de carduri cadou altor categorii de beneficiari decât angajaţilor proprii.

Legea tichetelor cadou poate fi consultata aici: https://www.edenred.ro/ro/legal-center#legislatie/tichete-cadou

Angajatorul suportă toate costurile legate de emiterea și acordarea cardurilor Edenred Cadou pe suport electronic. Conform legii, cardul nu implică nici un cost suplimentar pentru angajat.

Lista este disponibila in contul MyEdenred al companiei unde clientul poate accesa informatii referitoare la fiecare card.

Clientul poate solicita trimiterea urmatoarelor informatii prin email sau SMS pentru a informa utilizatorii cu privire la: numărul de tichete încărcate, valoarea nominală a unui tichet, valoarea totală încărcată, soldul cardului după încărcare.

Pentru a primi notificarea, clientul trebuie sa completeze in fisierul de comanda adresa de email si numarul de telefon al utilizatorilor de card

Alternativ, utilizatorii de card pot afla în permanență soldul cardului și istoricul tranzacțiilor prin aplicația mobile My Edenred sau prin platforma online My Edenred.

Nu se pot incarca sumele de pe cardurile cadou pe cardurile de masa

Nu, cardul este valid doar în cadrul companiei unde activa salariatul atunci când l-a primit.

Daca printr-o eroare s-a incarcat o suma eronat pe card, clientul poate solicita catre Edenred rezolvarea situatiei prin retragerea sumei incarcate gresit pe card.

Potrivit legii, la încetarea contractului individual de muncă, salariatul are obligația să restituie angajatorului contravaloarea tichetelor cadou alimentate pe card și neutilizate ori necuvenite.

Legislația aplicabilă nu impune obligația salariatului de a restitui suportul electronic (cardul) pe care au fost sau sunt încărcate tichetele cadou, însă salariatul are obligația să restituie angajatorului contravaloarea tichetelor cadou alimentate pe card și neutilizate ori necuvenite.

Timpul de livrare a cardurilor noi este de maximum 6 zile lucrătoare, conform contractului.

După ce a fost stabilit vizualul noului card împreună cu compania client și Edenred, livrarea acestora se poate face în 10 zile lucrătoare.

CarduriIe se reîncarcă in aceeasi zi daca plata este efectuata din aceeasi banca; daca ce face plata dintr-o alta banca incarcarea poate efectua într-o zi lucrătoare de la încasare. Valoarea tichetelor cadou nu va putea fi transferată salariaților pe card decât dacă angajatorul a achitat contravaloarea nominală a acestora, inclusiv costurile aferente emiterii, către Edenred”

Pentru emitere de noi carduri (noi angajați)

1. Compania trimite comanda catre Edenred prin incarcarea fisierului de comanda, cu informatiile aferente, in platforma MyEdenred

2. Edenred emite factura proforma și aceasta este plătită de către angajator

3. Angajatorul primește cardurile noi și le distribuie salariatilor

4. Angajatorul primește o notificare automată de la Edenred după fiecare comandă, conținând informațiile comenzii plasate. În corpul acestui e-mail va găsi Parola de recepționare carduri și Numărul de comandă. Angajatorul trebuie să trimită aceste informații (parolă și număr comandă) către Edenred, utilizând adresa de e-mail specificată în contract la nivel de Responsabil recepție carduri. Mesajul conținând parola de recepționare și numărul comenzii trebuie trimis de către client DOAR de la adresa de email a responsabilului de recepție carduri înscrisă în contract. Transmiterea respectivului mesaj reprezintă confirmarea faptului că angajatorul ori salariații săi se află deja în posesia cardurilor pe care urmează să fie încărcate tichetele Cadou)

5. Edenred alimentează cardurile. Din motive de siguranță, cardurile nou-emise vor fi încărcate cu sumele corespunzătoare doar după confirmarea recepției de către angajator.

Pentru reîncărcarea cardurilor deja existente și confirmate

1. Compania trimite la Edenred fișierul de comandă, completat cu informațiile aferente reîncărcării. Se selectează perioada pentru care se dorește comanda (pentru următoarele 4 ocazii sociale, respectiv Crăciun, Paşte, 8 Martie şi 1 Iunie, tichetele cadou vor fi scutite de taxe şi contribuții).

2. Edenred emite factura proforma și aceasta este plătită de către angajator

3. Se alimentează carduriIe în maxim 1 zi lucrătoare de la încasare.

Nu este permisă alimentarea cardului Cadou cu alte sume în afara celor reprezentând contravaloarea tichetelor cadou.

Prin MyEdenred folosind un fișier Excel template pe care Edenred îl pune la dispoziția angajatorului. În același fișier există un sheet pentru comanda de carduri noi și un sheet pentru comenzi recurente de reîncărcare.

Tichetele cadou pe suport electronic sunt bilete de valoare acordate ocazional angajaţilor proprii pentru cheltuieli sociale. Cardurile sunt emise de Edenred sub sigla MasterCard® și sunt prevăzute cu CIP, încorporând cea mai nouă tehnologie ce conferă securitate sporită și viteză. Cardurile Edenred Cadou pot fi folosite și în modul “Contactless”, fără necesitatea introducerii codului PIN pentru plățile sub 100 lei.

Acceptarea cardurilor Cadou emise de Edenred se face utilizând POS-urile existente deja în magazinele dumneavoastră. Astfel, înrolarea POS-urilor în rețeaua noastră nu implică niciun cost suplimentar pentru comercianți. Din punct de vedere comercial, acceptarea cardurilor presupune semnarea unui contract sau a unui act adițional la contractul inițial cu Edenred (dacă e cazul).

Prin acceptarea la plată a Cardului Cadou emis de Edenred, comercianții parteneri beneficiază de o decontare mai rapidă a sumelor corespunzătoare tichetelor cadou pe card, în aproximativ 24h de la momentul plăţii, așa cum ați negociat cu banca acceptatoare de la care aveți POS. De asemenea, se simplifică gestiunea tichetelor pe card, prin reducerea costurilor de manevrare: eliminarea ștampilării și datării tichetelor pe verso, depozitării, numărării și centralizării, transportului și a rambursării acestora. Cardurile cadou permit plata cu orice sumă aflată pe card, indiferent de valoarea unui tichet Cadou, iar plata cu cardul este mai rapidă şi mai sigură datorită tehnologiei „contactless”.

Tichetele Edenred Cadou pe card pot fi utilizatenumai în magazinele partenere care sunt dotate cu POS-uri şi care au contract de acceptare la plata a acestor tichete încheiat cu Edenred, emitentul tichetelor Edenred Cadou pe card.

În situaţia în care clientul returnează produsul achiziţionat din unitatea dumneavoastră, puteţi rambursa suma aferentă pe card, urmând procedura standard de rambursare pentru carduri. Sumele nu pot fi rambursate pe carduri expirate. În această situaţie, puteţi oferi alte produse în schimb, în conformitate cu politica internă a unităţii dumneavoastră, dar nu puteţi returna în nicio situaţie contravaloarea printr-o altă metodă de plată.

Sumele sunt decontate conform contractului încheiat cu instituţia financiară deţinătoare a POS-ului prin care s-au efectuat tranzacţiile, fără intervenția Edenred.

La momentul achitării produselor, de pe cardurile Edenred Cadou va fi debitată valoarea integrală a produselor cumpărate, chiar dacă aceasta presupune utilizarea de fracţii ale valorii nominale a unui tichet.

Cardurile Edenred Cadou sunt compatibile cu POS-urile deja existente în magazinele care au contract încheiat cu Edenred pentru acceptarea tichetelor Edenred Cadou , deci nu e nevoie de investiții suplimentare din partea comercianților.

Începând cu data de 01 februarie 2022, tichetele cadou se emit exclusiv pe suport electronic (card). În continuare, în piață, vor mai exista tichete Edenred Cadou care au fost emise pe suport hârtie până la data de 31 ianuarie 2022 și care vor fi valabile până la data expirării lor, astfel cum este înscrisă pe acestea.

După înregistrarea unui card, în cazul în care acesta este emis dar inactiv, îl poți activa accesând butonul „Activează” din aplicatia My Edenred sau platforma online My Edenred, din pagina cu lista cardurilor, apoi selectând din meniu opțiunea “Activează cardul meu”. Ai nevoie de codul care se afla in scrisoarea care insoteste cardul.

Conform dispoziţiilor legale în materie, tichetele Edenred Cadou sunt bilete de valoare acordate, ocazional, propriilor angajaţi, pentru cheltuieli sociale.

Tichetele Edenred Cadou acordate propriilor salariați sau în beneficiul copiilor minori ai acestora în limita a 300 de lei /persoană/eveniment sunt scutite de la plata contribuțiilor sociale obligatorii şi a impozitului pe venit. Evenimentele sociale care beneficiază de tratamentul fiscal menționat anterior sunt cele prevăzute expres de Codul fiscal, respectiv Crăciunul, Paştele, sărbătorile similare ale altor culte religioase, 8 Martie (pentru salariate) şi 1 Iunie (pentru copii). Tichetele Edenred Cadou acordate care depășesc limita de 300 de lei/persoană/eveniment sunt supuse atât impozitului pe venit, cât și contribuțiilor sociale obligatorii.

. Începând cu 1 ianuarie 2022 este interzisă acordarea de tichete cadou altor categorii de beneficiari decât angajaţilor proprii.

In general pentru plățile “Contactless” ce depășesc 100 de lei este obligatorie introducerea codului PIN

Pentru plățile “Contactless” ce depășesc 100 de lei este obligatorie introducerea codului PIN.

Codul PIN este necesar în cazul plăților clasice (non-contactless) și în cazul plăților “contactless” care au o valoare de peste 100 de lei.

Nu, conform legii, cardurile Edenred Cadou nu permit retragerea sau transferul de fonduri, ci pot fi utilizate exclusiv pentru achiziționarea bunurilor și serviciilor pentru care au fost emise.

Nu, potrivit legii, comenzile de carduri Edenred Cadou se pot procesa doar în baza unei comenzi ferme efectuate de către compania angajatoare, care a semnat un contract cu Edenred.

În situaţia în care beneficiarul tichetelor cadou returnează produsul achiziţionat cu cardul Edenred Cadou, suma aferentă poate fi rambursată pe card, urmând procedura standard de rambursare pentru carduri. Sumele nu pot fi rambursate pe carduri expirate. În această situaţie, pot fi oferite alte produse în schimb, în conformitate cu politica internă a unităţii partenere Edenred, dar nu poate fi returnată în nicio situaţie contravaloarea printr-o altă metodă de plată.

La momentul achitării produselor, in cadrul unităților partenere Edenred, de pe cardurile Edenred Cadou este luată valoarea integrală a produselor cumpărate, chiar dacă aceasta presupune utilizarea de fracții ale valorii nominale a unui tichet.

Utilizatorii cardurilor pot alege să plătească fie introducând cardul în POS și tastând codul PIN, fie prin tehnologia "contactless" în cadrul unităților care afișează sigla "contactless", prin simpla apropiere a cardului de cititorul special.

• Pentru plățile contactless sub 100 de lei nu este necesar codul PIN, iar ridicarea chitanței este opțională

• Pentru plățile contactless ce depășesc 100 de lei este obligatorie confirmarea prin cod PIN

• Pentru orice tranzacție inițiată contactless, dar eșuată, se va relua plata în mod standard, prin introducerea cardului în POS

Important: înainte de a efectua prima tranzacție “contactless”, este necesar să se efectueze în prealabil cel puțin o tranzacție introducând cardul în POS și tastând codul PIN.

Da, utilizatorii au libertatea să cheltuie orice sumă doresc din fondurile disponibile pe card. Nu există un minim obligatoriu, iar maximul este dat de suma existentă pe card la acel moment.

Cardul se blocheaza daca se introduce codul PIN de cel putin 3 ori gresit in aceeasi zi. Deblocarea cardului se face automat, in ziua urmatoare, Recomandarea este sa va reamintiti PIN ul inainte de a incerca folosirea cardului.

PIN-ul poate fi reamintit prin intermediul contului de utilizator din aplicația mobilă sau platforma online MyEdenred ori prin apel la 021 301 33 66.

Conform legii este interzis angajatorilor să taxeze în vreun fel angajații sau să diminueze valoarea nominală a tichetelor cadou pe suport electronie. Toate costurile aferente tichetelor cadou pe suport electronic vor fi suportate de către angajatori.

În caz de pierdere sau furt, cardul trebuie blocat imediat, pentru a nu pierde sumele încărcate pe acesta. Cardul se poate bloca (ireversibil) prin intermediul contului de utilizator din aplicația mobilă My Edenred, din platforma online sau prin apel la numarul 021 301 33 66. În cazul în care un beneficiar dorește blocarea temporară a cardului, în speranța că îl va găsi, cardul poate fi blocat temporar (reversibil) prin aceleași mijloace menționate mai sus.

Sumele alimentate pe cardurile Edenred Cadou au valabilitate un an de la data incarcarii.

Edenred oferă tuturor posesorilor de carduri, acces permanent și gratuit la informații despre soldul cardului și istoricul tranzacțiilor prin următoarele canale:

- contul web My Edenred

- aplicația mobilă My Edenred, care poate fi descărcată pe telefoanele de tip smartphone iOS, Android

- prin apel la numărul de telefon 021 301 33 66 (IVR-robot telefonic sau operator)

- pe email, angajații sunt înștiințați automat de către Edenred cu privire la data alimentării, valoarea tichetelor Cadou transferate pe suport electronic și soldul cardului după încărcare

Tichetele cadou au valabilitate de un an de la data incarcarii pe card. Dupa data expirarii, contravaloarea acestora se pierde si nu mai poate fi reincarcată pe card. Angajatorul poate solicita restituirea, la valoarea lor nominală, a tichetelor cadou alimentate pe suport electronic și neutilizate în perioada de valabilitate, potrivit contractului de client încheiat cu Edenred.

Valabilitatea suportului electronic este de 4 ani. Sumele încărcate pe card au valabilitate un an de la data incarcarii.

În prezent, Edenred deține cea mai extinsă rețea de comercianți parteneri la nivel național, acoperind toate județele. Cardurile pot fi folosite doar în magazinele dotate cu POS și care au semnat un contract cu Edenred pentru acceptarea la plata a acestor carduri. Se poate plăti cu cardul Edenred Cadou în cea mai dezvoltată rețea de comercianți parteneri cu acoperire 100% națională (modă, bijuterii, IT&C, sport, amenajări interioare, supermarketuri, benzinarii, frumusete, etc) care se poate accesa de aici https://www.edenred.ro/ro/parteneri-card-cadou sau de aici https://www.edenred.ro/ro/comercianti-parteneri